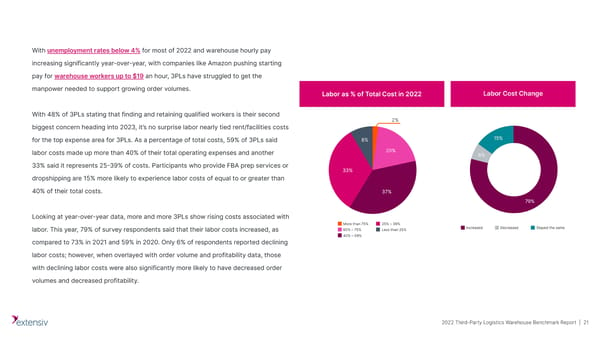

With unemployment rates below 4% for most of 2022 and warehouse hourly pay increasing significantly year-over-year, with companies like Amazon pushing starting pay for warehouse workers up to $19 an hour, 3PLs have struggled to get the manpower needed to support growing order volumes. With 48% of 3PLs stating that finding and retaining qualified workers is their second biggest concern heading into 2023, it’s no surprise labor nearly tied rent/facilities costs for the top expense area for 3PLs. As a percentage of total costs, 59% of 3PLs said labor costs made up more than 40% of their total operating expenses and another 33% said it represents 25-39% of costs. Participants who provide FBA prep services or dropshipping are 15% more likely to experience labor costs of equal to or greater than 40% of their total costs. Looking at year-over-year data, more and more 3PLs show rising costs associated with labor. This year, 79% of survey respondents said that their labor costs increased, as compared to 73% in 2021 and 59% in 2020. Only 6% of respondents reported declining labor costs; however, when overlayed with order volume and profitability data, those with declining labor costs were also significantly more likely to have decreased order volumes and decreased profitability. 2022 Third-Party Logistics Warehouse Benchmark Report | 21

Third-Party Logistics | Upload & Go Page 20 Page 22

Third-Party Logistics | Upload & Go Page 20 Page 22