Third-Party Logistics | Advanced version

2022 Third-Party Logistics Warehouse Benchmark Report

This is a modal window.

Table of Contents 03 Foreword 24 Technology Adoption 04 Key Findings 30 Reporting and Analytics 05 The 3PL Warehouse Landscape 35 Billing and Invoicing 10 Growth Opportunities 39 Conclusion 17 Capacity Constraints 40 Methodology 20 Labor Constraints 42 About Extensiv

Foreword In August 2022, Extensiv (formerly 3PL Central) distributed an online survey to logistics professionals who own or operate third-party logistics (3PL) warehouses. The aggregated responses to this survey comprise the information found in the following report. As the first and only report 100% focused on the 3PL warehouse industry, Extensiv’s Benchmark Report aggregates data from more than 200 3PL warehouses and provides insight on more than 30 industry-specific topics. This information builds on data collected in 2020 and 2021 and provides year-over-year changes or trends when applicable. The Benchmark Report examines best practices, trends, current issues, and opportunities facing 3PL warehouses.

Key Findings

The 3PL Warehouse Landscape

INDUSTRIES SERVED INDUSTRIES SERVED YEAR-OVER-YEAR This year, many 3PLs focused on specializing in specific industries, with 3PL warehouses serving 2.9 industries—down from 3.5 industries last year—showing that with the increased demand that many 3PLs saw this past year, they doubled down on industries and workflows that better align with their strengths. The largest industry concentrations include retail, dry storage, and bulk goods. Bottled goods/wine and spirits and pharmaceuticals/nutraceuticals showed the largest decrease, dropping 33% and 32% respectively, indicating a possible correlation with some historic COVID-related increases in 2021. Other categories remained mostly flat year-over-year, except hazmat, which showed marked growth, jumping from 10% to 16%.

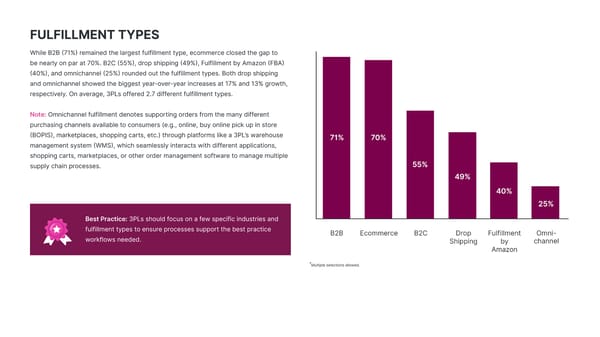

FULFILLMENT TYPES While B2B (71%) remained the largest fulfillment type, ecommerce closed the gap to be nearly on par at 70%. B2C (55%), drop shipping (49%), Fulfillment by Amazon (FBA) (40%), and omnichannel (25%) rounded out the fulfillment types. Both drop shipping and omnichannel showed the biggest year-over-year increases at 17% and 13% growth, respectively. On average, 3PLs offered 2.7 different fulfillment types. Note: Omnichannel fulfillment denotes supporting orders from the many different purchasing channels available to consumers (e.g., online, buy online pick up in store (BOPIS), marketplaces, shopping carts, etc.) through platforms like a 3PL’s warehouse management system (WMS), which seamlessly interacts with different applications, shopping carts, marketplaces, or other order management software to manage multiple supply chain processes. Best Practice: 3PLs should focus on a few specific industries and fulfillment types to ensure processes support the best practice workflows needed. *Multiple selections allowed.

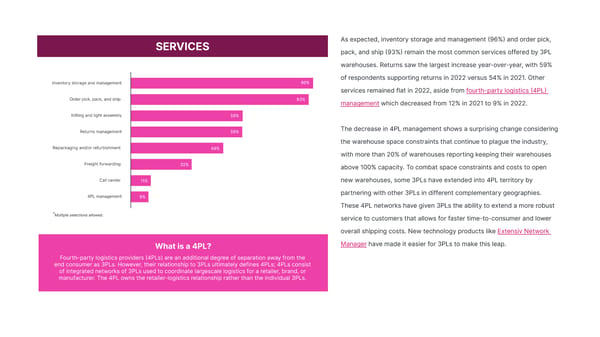

SERVICES As expected, inventory storage and management (96%) and order pick, pack, and ship (93%) remain the most common services offered by 3PL warehouses. Returns saw the largest increase year-over-year, with 59% of respondents supporting returns in 2022 versus 54% in 2021. Other services remained flat in 2022, aside from fourth-party logistics (4PL) management which decreased from 12% in 2021 to 9% in 2022. The decrease in 4PL management shows a surprising change considering the warehouse space constraints that continue to plague the industry, with more than 20% of warehouses reporting keeping their warehouses above 100% capacity. To combat space constraints and costs to open new warehouses, some 3PLs have extended into 4PL territory by partnering with other 3PLs in different complementary geographies. These 4PL networks have given 3PLs the ability to extend a more robust *Multiple selections allowed. service to customers that allows for faster time-to-consumer and lower overall shipping costs. New technology products like Extensiv Network What is a 4PL? Manager have made it easier for 3PLs to make this leap. Fourth-party logistics providers (4PLs) are an additional degree of separation away from the end consumer as 3PLs. However, their relationship to 3PLs ultimately defines 4PLs; 4PLs consist of integrated networks of 3PLs used to coordinate largescale logistics for a retailer, brand, or manufacturer. The 4PL owns the retailer-logistics relationship rather than the individual 3PLs.

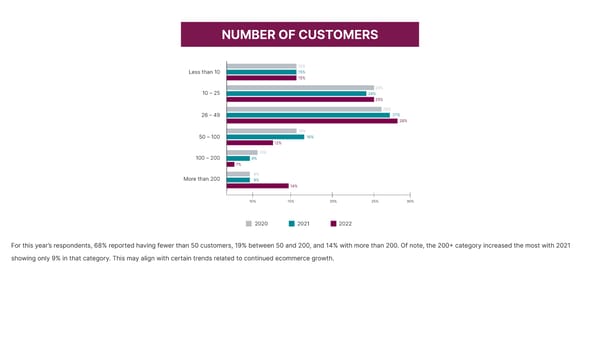

NUMBER OF CUSTOMERS For this year’s respondents, 68% reported having fewer than 50 customers, 19% between 50 and 200, and 14% with more than 200. Of note, the 200+ category increased the most with 2021 showing only 9% in that category. This may align with certain trends related to continued ecommerce growth.

Growth Opportunities

ORDER VOLUME GROWTH Although 2022 has brought concerns around inflation, a recession, greater labor constraints, and some global uncertainty, 3PLs fared even better than in past years as it related to order volumes with 91% growing order volumes in 2022. This shows a continued positive trajectory from 2020 and 2021, where order volumes increased for 79% and 85% of 3PLs, respectively. This year showed fewer declines as well, dropping from the high of 12% in 2020 to only 4% in 2022, demonstrating momentum for nearly the entire industry. While an average of 51% of warehouses across fulfillment types saw an increase in order volume above 25%, those 3PLs supporting omnichannel fulfillment saw 13% more growth over other fulfillment types. While the 3PLs with the highest order volume growth also had the highest profitability growth, order volume increases did not always equate to profitability Best Practice: As order volumes increase, monitor and optimize customer-level profitability. growth. In fact, 33% of the participants indicating medium With many 3PLs running on slim margins, times of high demand can offer the opportunity to order volume growth (10–24%) indicated they had low to adjust pricing levels and ensure you have the right customers for your business. It’s also a good time to evaluate slow moving inventory to ensure that precious warehouse space is allocated to negative profitability growth. faster-moving inventory that will generate more revenue than storage alone.

GROWTH DRIVERS *Multiple selections allowed. This year, new customer acquisition, increased ecommerce ordering, and diversifying fulfillment types drove order volume growth. New customer growth saw the biggest year-over- year increase with 81% of 2022 respondents citing it as a primary reason for growth as compared to 71% in 2021 and 66% in 2020. Other categories not expressly listed include growth from existing customers and a strong economy. Those customers who saw declines attributed volume declines to customer demand, economic fluctuations, and a post-pandemic return to retail.

PRIMARY NEW BUSINESS CHANNEL With new customer acquisition fueling this year’s order volume increases, it indicates significant demand for 3PL partners in the market. Even looking at customer acquisition channels, inbound or prospective customer-driven activities fueled most of the growth with referrals at 75%, inbound emails or calls at 65%, and website requests at 64%. Of note, inbound email and call requests significantly jumped year-over-year from 55% in 2021. Paid advertisements dropped from 28% in 2021 to 18% in 2022, possibly fueled by the number of inbound inquiries allowing 3PLs to grow their business without costly customer acquisition strategies. New business from 4PL networks (e.g., Deliverr, ShipBob, etc.) decreased dramatically from 15% in 2021 to 2% in 2022, which is consistent with many 3PLs protecting both their margins and warehouse capacity. Best Practice: With so many brands looking for 3PL warehouses, consider how to generate more inbound inquiries, whether through organized customer referral programs or even industry-related company listings like Extensiv Fulfillment Marketplace where you can * list your company’s core capabilities and gain access to new business. Multiple selections allowed.

PROFITABILITY GROWTH With new business abounding for 3PLs, many were able to capitalize on the demand to drive greater profitability for their business. When asked if their profitability improved during the past year, 81% indicated yes, with 38% indicating “high” profitability growth of more than 25%. Thirty-one percent (31%) indicated medium profitability growth of 10–24%. Eighteen (18%) of 3PLs performing omnichannel fulfillment saw a 50% increase in profitability over the prior year, which is 33% more than the average of other 3PLs. Participants with less than 10 customers were 42% more likely to see high profitability in 2022 over participants with >10 customers.

On the tail of a great new customer acquisition year, 3PLs display significant optimism for continued growth next year. Respondents identified acquiring new customers (77%), growth related to ecommerce (56%), and automating warehouse processes (53%) as their top three biggest opportunities for 2023. Of note, fewer 3PLs identified diversifying services as one of their top three opportunities, decreasing to 33% this year from 43% in 2020. This aligns with the reduction in fulfillment type and industries seen earlier in the report. However, respondents who experienced medium to high profitability attribute their growth to “diversifying fulfillment types” at a rate of 21% or 1.2x more than other reasons listed. *Three selections allowed.

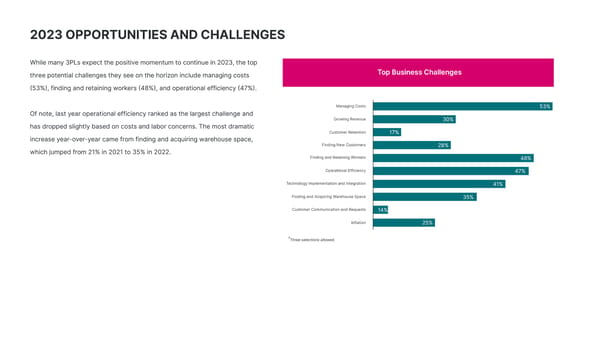

2023 OPPORTUNITIES AND CHALLENGES While many 3PLs expect the positive momentum to continue in 2023, the top three potential challenges they see on the horizon include managing costs (53%), finding and retaining workers (48%), and operational efficiency (47%). Of note, last year operational efficiency ranked as the largest challenge and has dropped slightly based on costs and labor concerns. The most dramatic increase year-over-year came from finding and acquiring warehouse space, which jumped from 21% in 2021 to 35% in 2022. *Three selections allowed.

Capacity Constraints

WAREHOUSES AND WAREHOUSE SPACE Experts predict that businesses will struggle to find additional warehouse space through the end of 2023 because of low vacancies and higher rent. This may limit some 3PLs’ ability to grow, as brands increase inventory levels taking up the precious little available space 3PLs currently have to mitigate any supply chain concerns. In some cases, brands have asked their 3PLs to stock a surplus of slow moving inventory, making the warehouse capacity crunch even more acute. This year, 39% of 3PLs identified adding warehouses in new locations as one of the most significant opportunities in the coming year, while 35% identified finding available warehouse space as one of their biggest challenges. Let’s examine the current warehouse space and capacity footprint. Eighteen percent (18%) of 3PL respondents have more than six warehouses, while 47% have two to five, and 35% have one warehouse. Fifty-one percent (51%) have less than 100,000 square feet of space, 21% operate between 100,000 and 250,000 sq. ft., and the remaining 28% have more than 250,000 sq. ft.

This year, more warehouses are operating at or beyond capacity than ever before—with 20% indicating they are operating beyond 100%, increasing from 15% in 2021. Nearly 40% of warehouses cited running at 90% – 99% capacity, highlighting the responses referenced earlier that finding warehouse space will continue to be a challenge in 2023. Survey respondents who keep their warehouse at between 80% and 99% capacity are more likely to experience medium to high order volume growth, 1.5x more than those who keep them less than 80% capacity, and 1.15x more than those who keep them at more than 100% capacity. With nearly 60% of warehouses utilizing more than 90% of their space and another 28% running between 80%-89%, significant risk exists for 3PLs to keep up with customer growth and inventory levels. Once warehouses reach 80%–85% space utilization, many find that efficiency drops with movement and storage. This also indicates a level beyond where some 3PLs might struggle with adding new Best Practice: Evaluate slow-moving inventory. 3PLs can increase revenue customers or managing seasonal fluctuations. and persuade customers to reduce stock of slow-moving inventory by pricing long-term storage at a higher rate, thereby preserving valuable space in the warehouse.

Labor Constraints

With unemployment rates below 4% for most of 2022 and warehouse hourly pay increasing significantly year-over-year, with companies like Amazon pushing starting pay for warehouse workers up to $19 an hour, 3PLs have struggled to get the manpower needed to support growing order volumes. With 48% of 3PLs stating that finding and retaining qualified workers is their second biggest concern heading into 2023, it’s no surprise labor nearly tied rent/facilities costs for the top expense area for 3PLs. As a percentage of total costs, 59% of 3PLs said labor costs made up more than 40% of their total operating expenses and another 33% said it represents 25-39% of costs. Participants who provide FBA prep services or dropshipping are 15% more likely to experience labor costs of equal to or greater than 40% of their total costs. Looking at year-over-year data, more and more 3PLs show rising costs associated with labor. This year, 79% of survey respondents said that their labor costs increased, as compared to 73% in 2021 and 59% in 2020. Only 6% of respondents reported declining labor costs; however, when overlayed with order volume and profitability data, those with declining labor costs were also significantly more likely to have decreased order volumes and decreased profitability.

WAREHOUSE STAFFING CHALLANGES With more than half (51%) of 3PLs growing their order volume by more than 25% in 2022, hiring has increased commensurately to support order growth. Despite optimizing and automating warehouses when possible, many still rely heavily on the workforce to meet that demand. Not surprisingly, finding qualified workers (46%) ranks as the primary warehouse labor challenge. Cost (14%), turnover (13%), and time-to-productivity (11%) rounded out the top four biggest labor challenges. Although still a relatively small amount, absenteeism tripled its respondents from 2% in 2021 to 6% in 2022, indicating this may be a future issue to watch. The 3PLs with the highest profitability were more likely to select turnover or time-to-productivity as their largest labor challenge as Best Practice: Consider the career path for warehouse workers and help them identify opportunities for growth and advancement. With the adoption compared to low to negative profitability companies. of new technologies and processes, warehouses are ripe with opportunities for people wanting to grow their careers. By framing up the longer-term opportunities, warehouses can better retain existing talent and use training to build skills for their workforce.

Despite growing labor costs, 71% of 3PL respondents intend to increase their workforce in 2023, while 27% intend to remain the same, and only 2% expect to reduce the size of their workforce. This indicates planned investment and a more positive outlook. Companies that experienced the highest order volume growth in 2022 are 5x more likely to expect labor growth than those with low to no growth. Considering low unemployment, rising labor costs, and the expectation that 3PLs will continue to grow their workforce in 2023, it’s no surprise that 53% of 3PLs see automating processes in the warehouse as one of their biggest opportunities for the year ahead. 3PLs will need to heighten focus on hiring and retention strategies to ensure they can expand their workforce and increase service demand or find new ways to automate and reduce manual processes through technology.

Technology Adoption

TECHNOLOGY ADOPTION With 51% of 3PLs growing order volume in 2022 by more than 25% and with 48% struggling to find and retain workers, technology adoption has become a logical path for 3PLs seeking to scale their business and drive profitability. This year, warehouse management systems (WMS) ranked as the most (87%) implemented technology for 3PLs, followed by order management systems (OMS) (52%) and mobile barcode scanning (51%). Electronic Data Interchange (EDI) saw the largest jump this year with 44% of 3PLs saying they use EDI integrations in 2022 as compared to 34% in 2021. 3PLs had 3.8 different technologies implemented within their companies on average, with the high and medium profitability 3PLs typically having more than four systems installed. *Multiple selections allowed.

REASONS FOR ADOPTING WMS As the most commonly adopted technology, 3PLs stated their reasons for adopting WMS software were to support real-time inventory tracking and management (82%), drive greater accuracy (75%), and to improve operational efficiency (69%). Surprisingly, cutting costs dropped to 19% in 2022 as compared to 27% in 2021 and 33% in 2020. For those 3PLs who haven’t adopted a WMS yet, price and time to implement ranked their top concerns, although most 3PLs indicate a significant return on investment (ROI) for their WMS software. *Multiple selections allowed.

To drive efficiency and scalability, 3PLs have adopted WMS technology with 60% of respondents leveraging the technology to grow 11% or more. In fact, 38% of 3PLs used their WMS to scale order volumes by more than 25%. Nearly 53% of 3PLs think automating processes in their warehouses is a top opportunity for 2023, which re-enforces the greater technology investments seen this year. Because the labor shortage has continued throughout 2022 and appears poised to continue well into 2023, time savings and labor productivity appear throughout the survey responses as key imperatives for growing 3PLs. With 69% of respondents sharing they implemented a WMS in order to save time and improve operational efficiency, data shows that 3PLs have received significant returns in time savings. More than 73% of users saved 11+ hours per month, with 14% saving more than 50 hours per month. Participants who are involved in omnichannel fulfillment are, on average, 30% more likely to see time savings benefits over other fulfillment types after adding a WMS.

SYSTEMS INTEGRATED Rising consumer expectations have driven the need for improvements in speed to fulfill as well as visibility throughout the lifecycle of an order. This year, shopping integrations and EDI connections to 3PLs’ WMS systems increased dramatically. EDI integrations rose to 51% in 2022 as compared to only 39% in 2021. Shopping cart integrations also showed a dramatic increase jumping to 48% in 2022 from 33% in 2021. Other notable increases included marketplace integrations at 25% this year versus 17% in the prior year. On average, respondents had 2.7 additional systems integrated with their WMS. This grew from 2.3 system integrations in 2021. *Multiple selections allowed.

PLAN TO IMPLEMENT Many 3PLs have expressed plans to implement new technology in 2023, with the top three responses offering key functionality to drive profitability and operational efficiency, including billing and invoicing (32%), mobile barcode scanning (27%), and reporting and analytics (25%). On average, 3PLs are planning to implement 1.5 new technologies into their business in the coming year. *Multiple selections allowed.

Reporting and Analytics

TYPES OF REPORTING During the past three years, the 3PL warehouse industry has experienced rapid evolution and growth driven by changing consumer behavior, fluctuating supply chain dynamics, increased demand for ecommerce ordering, and continued labor shortages. These changes have driven heightened focus on key performance indicators (KPIs) and broader operational metrics to ensure operational efficiency. The leading types of reports and dashboards used by 3PLs include: basic inventory and order volume reports (81%), labor hours reporting (46%), and productivity dashboards (32%). The high and medium profitability growth 3PLs were more than twice as likely to perform time and motion studies and reporting, pointing to a focus on leading indicators for overall operating cost. *Multiple selections allowed.

TIME TO FULFILL AN ORDER Nearly 77% of consumers say they expect their deliveries in less than two days. The increasing pressure to shorten delivery times has pushed 3PLs to examine ways to get orders through the pick and pack process and ready for carrier handoff in less and less time, as well as exploring options for later cut off times through a larger number of carriers. This has raised the focus on metrics like time to fulfill an order to maximize time in which consumers can still place orders each day. This year, 29% of 3PLs stated that, on average, they would complete the order from receipt to ready for carrier handoff in less than 30 minutes. This is up from 22% in 2021. In total, 53% fulfill orders in less than an hour and 75% in less than three hours. The data suggests that, on average, if it takes longer than three hours to fulfill an order, the likelihood of experiencing medium to high profitability drops at an average rate of 1.58x.

While every 3PL measures success slightly differently, a few key metrics stand out as conventional measurements—revenue, order volume, worker productivity, and operational costs. One of the more interesting findings in the report is the way that high and medium profitability 3PLs look at their most important success measurements. Revenue and order volume ranked as the top metrics measured for the highest profitability companies. Just below those, higher profitability organizations focused on the areas that represented both cost and profit center leading indicators like worker productivity, labor hours, and single order pick time. Conversely, the low to negative profitability 3PLs focused more on general buckets like operational costs and percent of orders fulfilled, which could be interpreted as more lagging indicators. In fact, low to negative profitability 3PLs indicated that order volume Best Practice: Focus on leading indicators, that when changed, might have the and average single order pick time were their least important metric, biggest impact on revenue and profitability. For example, if you are concerned about although these two metrics might have the largest impact on a 3PL’s operational cost, then break that into smaller buckets that you can impact more broadly, like worker productivity and single order pick time. If you can decrease overall costs and potential revenue. single order pick time by 15%, you will see that impact in your worker productivity, operational costs, and potential throughput.

OPERATIONAL COSTS With operational costs listed as a key measurement for almost all 3PLs, understanding the breakdown of expenses can help when prioritizing revenue generation or cost reduction efforts. When asked what the largest expense areas for their business are, 3PLs responded: Rent, Lease, or Facility Costs Labor Systems and Technology Equipment Shipping Costs

Billing and Invoicing

INVOICE PREPARATION When ranking key performance measurements, 3PLs consistently rate revenue and profitability as the top three responses. Relying heavily on a 3PL’s ability to invoice and bill in an accurate and timely manner, revenue, and profitability can be significantly impacted by the process used to invoice and capture billable charges. The most common processes to tackle invoicing include accounting software (27%) and combining systems and manual processes (22%). Surprisingly, this year saw an increase in companies creating invoices manually from 13% in 2021 to 21% in 2022, indicating room for improvement in how systems can support 3PLs in billing efforts.

Nearly half (48%) of 3PL respondents spend less than two days per month billing and invoicing customers, while 17% spent more than a week. When overlaying data with how invoices get prepared, of those 3PLs using their WMS or a WMS integration with accounting software to create invoices showed less time on average spent on billing, with 64% completing the invoices in less than two days. Best Practice: Leverage billing automation to reduce time building invoices and seize the opportunity to drive more profit by automatically capturing billable events. While uncaptured charges (48%), lack of automation (46%), and complex customer setups (41%) represent the top three challenges for all 3PLs in the billing and invoicing process; those creating invoices manually experienced even greater frustration (~60%) related to uncaptured charges.

TIME TO PAYMENT In many cases, 3PLs receive customer payments quickly, with 22% getting paid within 15 days and 56% getting paid in under 30 days. Although 3PLs rank Days Sales Outstanding (DSO) or time to payment as their least used metric, 43% received payment from customers on average above 30 days, potentially linked to earlier responses indicating some lack of payment options or questions about invoice accuracy.

Conclusion While 2022 brought positive returns for most 3PLs, many 3PLs are approaching 2023 with caution and a focus on managing costs, specialization, and integration. Heading into the new year, the industry will not only need to watch continued labor shortages and warehouse capacity constraints, but also keep an eye on how inflation may impact overall operating expenses. Proactive management and automation efforts will drive efficiency in 2023. Along with caution, there is still much room for optimism. Ecommerce order volumes continue to increase, brands are actively looking for new 3PL partners, and profitability gains made this year create a great foundation for profitable growth in 2023. Year after year, 3PL warehouses demonstrate tremendous ability to thrive even in dynamic times. 3PLs have consistently adapted and created new opportunities in nearly every environment, from addressing supply chain disruptions, to coming up with creative solutions to support inventory surpluses or supporting new fulfillment types. In conclusion, although the outlook for 2023 is mixed, ecommerce order volume and new customer acquisition may prove to be significant bright spots. By following best-practice recommendations, 3PLs can drive optimization across their businesses and position.

Methodology

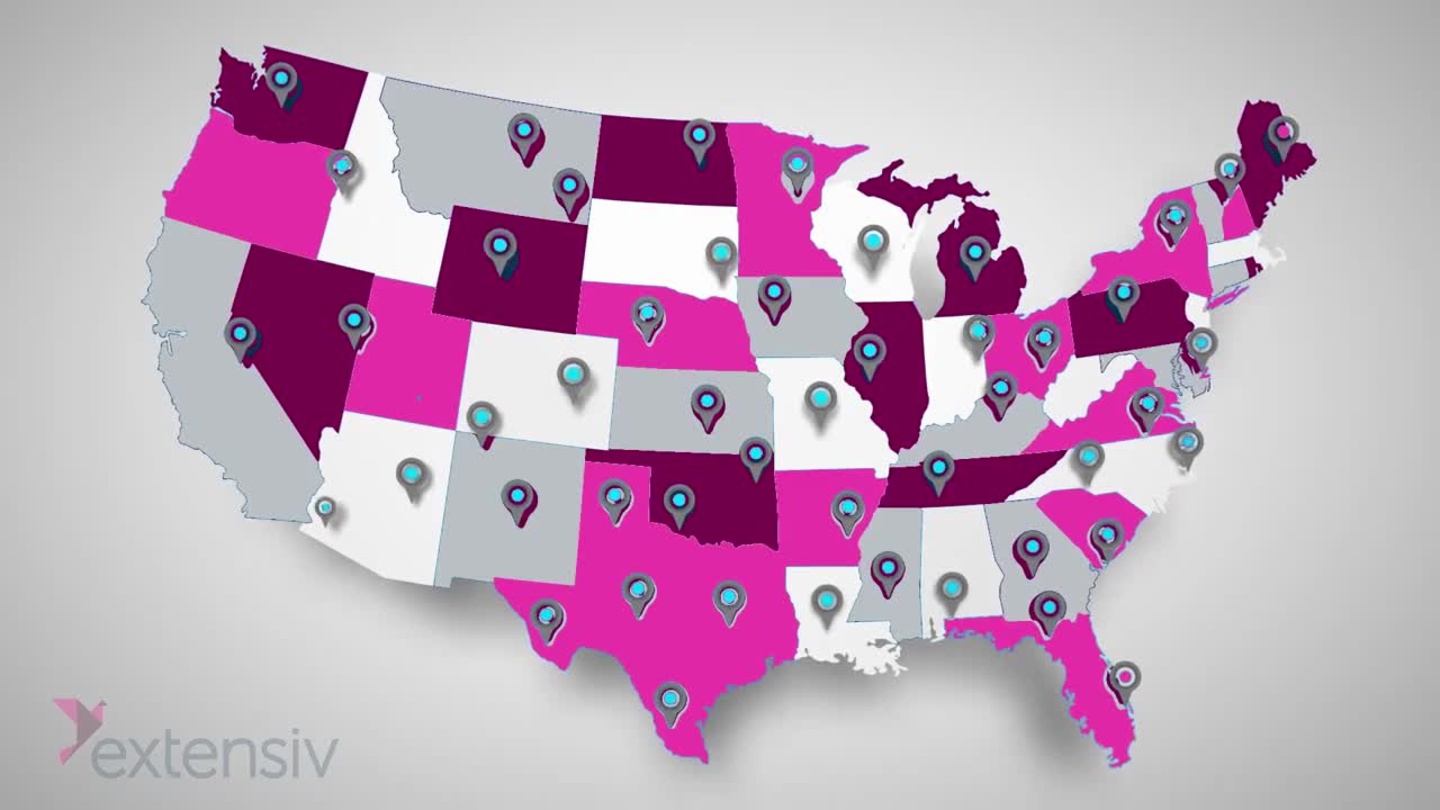

Approximately 39% held roles in Operations and Warehouse Management, 30% of respondents were Executives RESPONDENTS or Owners, and the remainder The survey was conducted online between August 11, 2022 and came from across other parts of September 5, 2022. There were 236 respondents who identified as 3PL the business. warehouses from across the United States, Canada, United Kingdom, Australia, and New Zealand. Of the respondent companies, 89% were traditional 3PL warehouses and 11% were hybrid private and public warehouses. FORMAT Survey questions included multiple choice, multiple selection, and open text. Figures may not add up to 100 percent due to rounding or multiple selection questions.

ABOUT EXTENSIV 3PL WAREHOUSE MANAGER Extensiv 3PL Warehouse Manager is the leading cloud-based warehouse management system (WMS) solution built to meet the unique needs of the 3PL warehousing community. Serving as the backbone of our customers’ operations, our platform quickly transforms paper-based, error-prone businesses into service leaders who can focus on customer satisfaction, operate more efficiently, and grow faster. Offering a comprehensive warehouse management platform, we make it easy for 3PLs to manage inventory, automate routine tasks, and deliver complete visibility to their customers. ABOUT EXTENSIV Extensiv is a visionary technology leader focused on creating the future of omnichannel fulfillment. We partner with warehouse professionals and entrepreneurial brands to transform their fulfillment operations in the radically changing world of commerce and consumer expectations. Through our unrivaled network of more than 1,500 connected 3PLs and a suite of integrated, cloud-native warehouse management (WMS), order management (OMS), and inventory management (IMS) software, we enable modern merchants and brands to fulfill demand anywhere with superior flexibility and scale without painful platform migrations as they grow. More than 25,000 logistics professionals and thousands of brands trust Extensiv every day to drive commerce at the pace that modern consumers expect. Interested in learning how Extensiv can help your business implement a comprehensive WMS platform and build best practices across your warehouse in 2023? REQUEST A DEMO For more information, please call us at 833-983-6748 or visit us online at www.extensiv.com. FOLLOW US © 2022 Extensiv I All rights reserved.